Modern Monetary Theory - MMT

What is MMT and how could it completely change your perception of life in a nation with a sovereign fiat currency? Looking for MMT resources in other languages? Try our INTERNATIONAL MMT RESOURCES page.

"If we just keep printing money, we'll devalue the dollar!"

"Printing money will cause inflation!"

"OhEmGee the National Debt!!"

We've all heard loads of rumors...now it's time to get the truth!

Use the arrows or swipe through the slides to learn more.

It's not something to implement someday, it is exactly how our money works TODAY!!

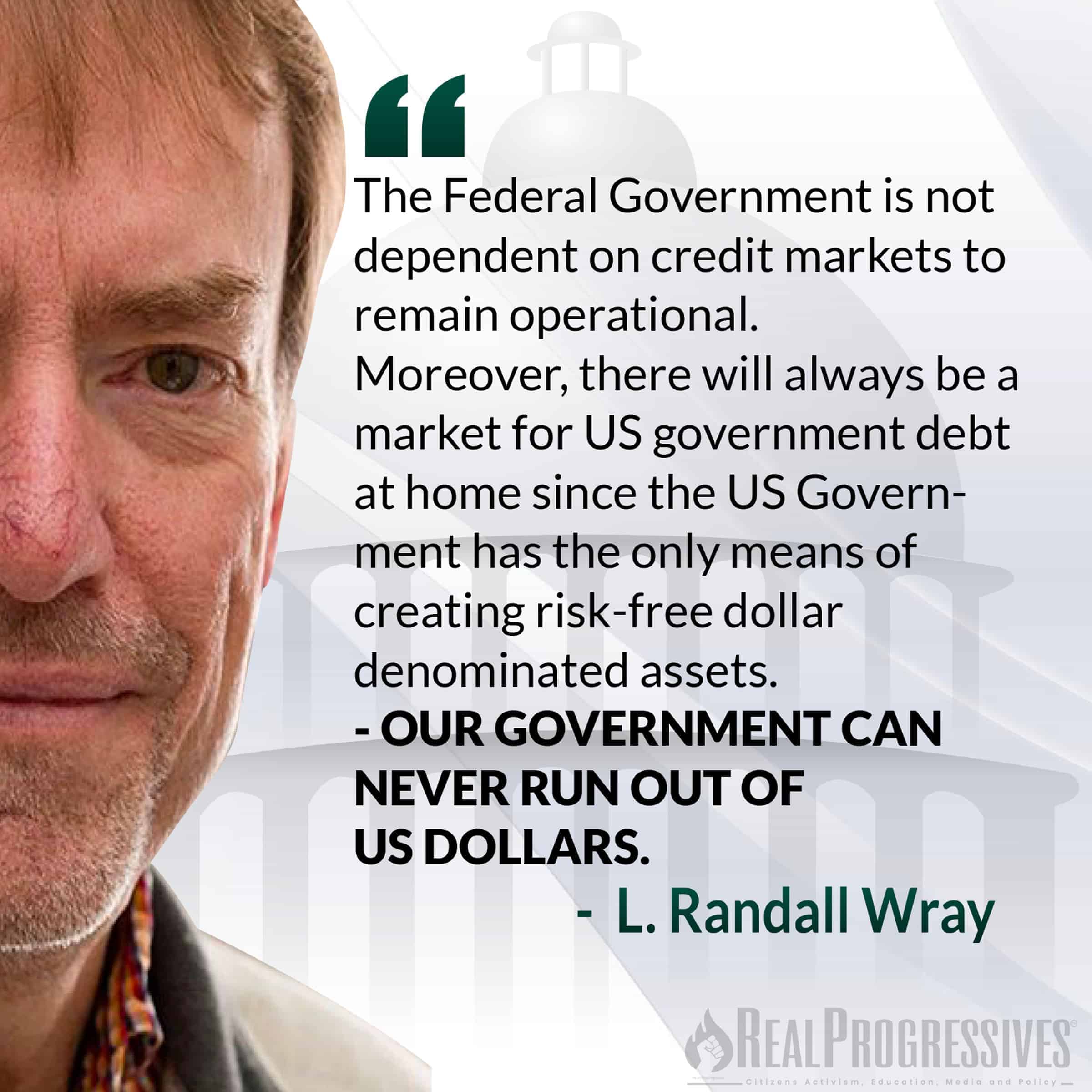

The currency issuer is not constrained to balanced budgeting in the same way as a currency user.

No matter what politicians or talking heads on TV say, when a country issues its own sovereign currency, it can never run out.

That would be like the scorekeeper in baseball running out of points! Crazy, right?

As a matter of fact, in order for us to pay taxes in the first place, the government, the CURRENCY ISSUER, has to create (or spend into existence) the money. Then, we CURRENCY USERS have to find a way to get some money to pay our taxes.

Most governments, most of the time, will run fiscal deficits. This is not a matter of concern, and is indeed a good thing, as it means most private sectors will be able to run the financial surpluses they wish to add to their net savings.

The government’s deficit is our surplus – we should be glad all that money hasn’t been taxed out of the economy!

Browse our MMT focused articles and filter them using the tabs at the top to find a specific topic.

Browse our MMT focused articles and filter them using the dropdown tab at the top to find a specific topic.

- All Articles

- Federal Reserve

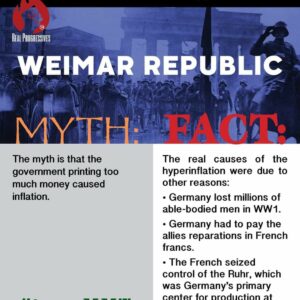

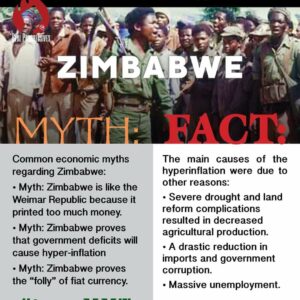

- Hyperinflation

- Inflation

- Job Guarantee

- MMT 101

- MMT Academics

- MMT Rebuttal

- National Debt

- Social Security

- Taxation

- All Articles

- Federal Reserve

- Hyperinflation

- Inflation

- Job Guarantee

- MMT 101

- MMT Academics

- MMT Rebuttal

- National Debt

- Social Security

- Taxation

“Liberal” Economists Cheered the New Democrats’ Deregulation of Finance

William K. Black April 13, 2016 * New Economic Perspectives Economic Justice

Hillary and Bill Clinton and Paul Krugman have pivoted in response to Bernie Sanders’ series of electoral wins and are racing hard right on finance and crime.

“Debt” Ceilings for Dummies

Greg Roest January 10, 2023 Economic Justice MMT Beginner

Beautifully simple are a sovereign nation’s sectoral balances. They readily demonstrate that the government’s negative is the public’s positive, and vice versa.

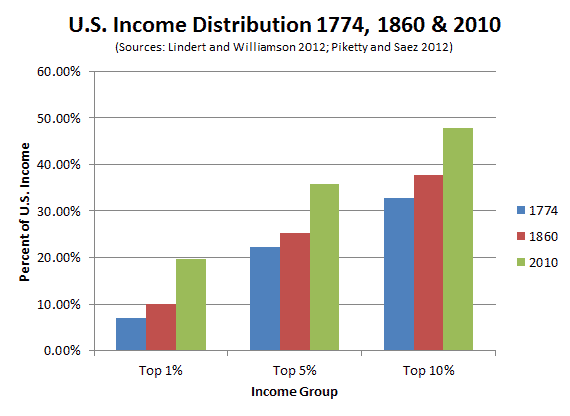

Yes, We Need to Start Taxing the Rich More: Here’s Why

Amanda Perry October 7, 2016 Economic Justice Published

Higher taxes on the rich are a means by which to slow the process of the accumulation of wealth. By slowing the process of accumulated wealth, higher top marginal taxes increase income equality.

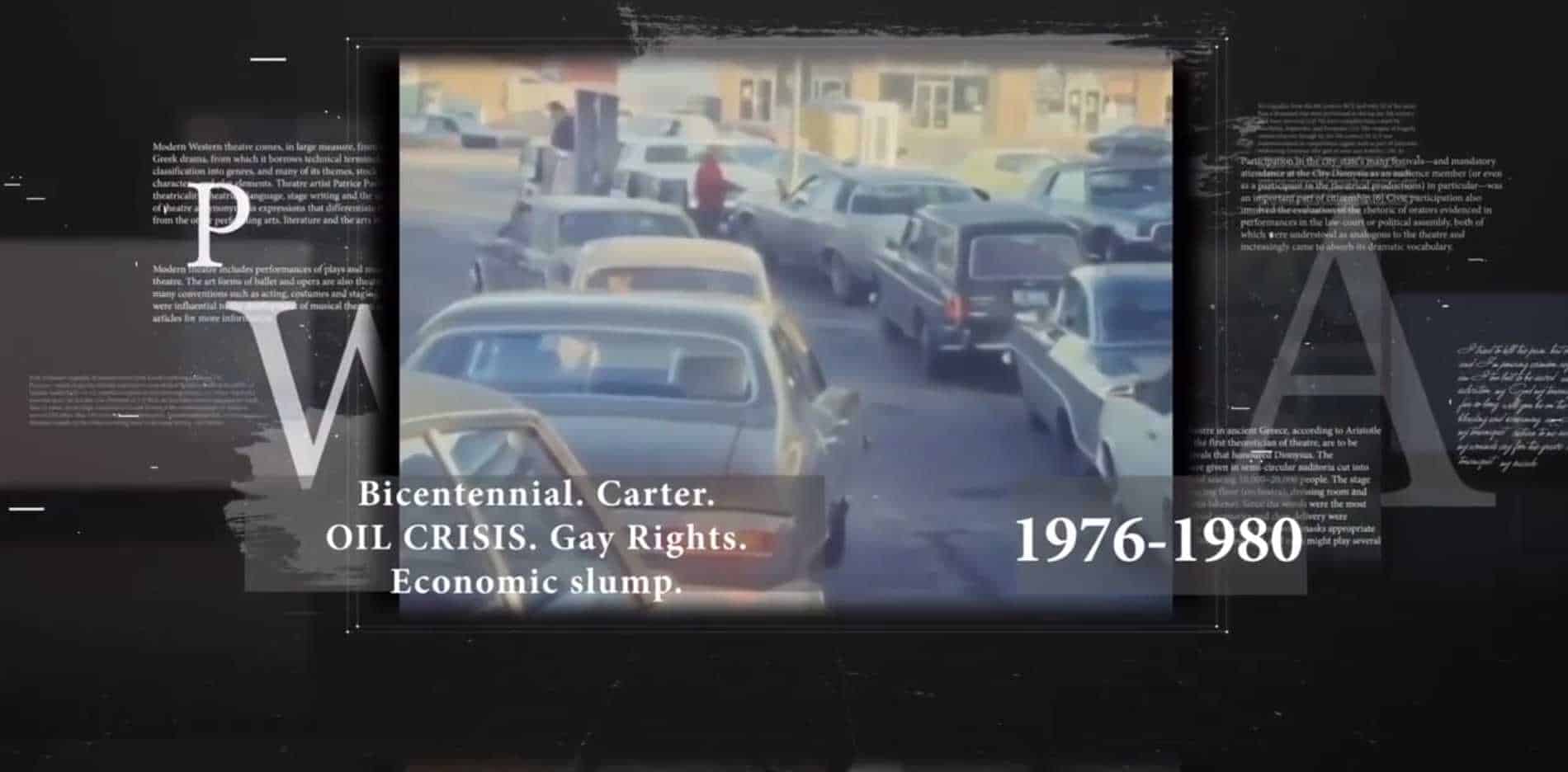

Why the New Deal Became the No Deal

J.D. ALT September 1, 2020 Economic Justice

The opening photo montage [on the Real Progressives home page] seems to be outlining an over-arching story about why American progressivism needs to make a …

Why Modern Monetary Theory is a Serious Idea for a Serious Time: A Response to James Pethokoukis

SJ Benson January 26, 2019 Economic Justice Informative

MMT is now being criticized by economic pundits, particularly from conservative think tanks. This commentary is a rebuttal to one such article.

Why MMT Progressivism is the Real Populism

J.D. ALT March 18, 2021 Democracy Economic Justice

Today’s “populists,”—both right and left—appear to believe that virtually anything the U.S. federal government does is an oppression of individual liberty, private rights and local …

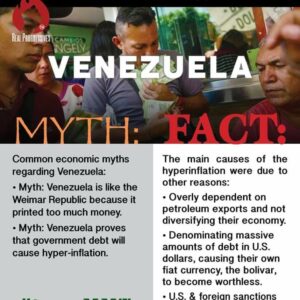

Why Government Spending Can’t Turn the U.S. Into Venezuela

Fadhel Kaboub August 31, 2020 Economic Justice

When poor countries fall prey to inflation, it’s not because they’re “too socialist.” The rising popularity of modern monetary theory (MMT) has inevitably brought misconceptions.

Why America’s “Shipping Crisis” Will Not End

Ryan Johnson November 17, 2021 Current Events Economic Justice

A first-person narrative of a truck driver with 20 years of experience of why nothing is going to change in the shipping industry.

Why America is Not a Country Club

J.D. ALT May 8, 2018 Economic Justice Informative

and why we should look to our board of directors to straighten it out.

White Paper: A National Investment Authority

Jabari Morris September 12, 2020 Economic Justice White Paper

Robert C. Hockett and Saule T. Omarova propose in the white paper listed below that the United States government create a ‘National Investment Authority’ as …

White Paper: Modern Monetary Theory (MMT)

Warren Mosler July 4, 2020 Economic Justice

The purpose of this white paper is to publicly present the fundamentals of MMT.

Where to Start Learning About MMT

Steven D. Grumbine March 22, 2022 Education Reference Material

Have you recently discovered MMT or Modern Monetary Theory and want to learn more but aren’t sure where to start? Well, start at the beginning, of course!

Why we need to debunk the 'deficit myth' - BBC REEL

Government spending is increasing at an unprecedented rate to deal with the effects of the coronavirus pandemic. Many people worry this could burden future generations.

However, economist Stephanie Kelton, author of The Deficit Myth, argues that we need to rethink our attitudes towards government spending.

Could Modern Monetary Theory help us navigate our way out of this crisis – and even help build a fairer economy?

Producer: Dan John

Animation: Jacqueline Nixon

(Republished with permission from the BBC)

Weaponizing knowledge, one mind at a time.

Visit our seven focused Knowledge Areas.